Deposit products at banks are currently experiencing a significant increase in popularity. This is the effect of increases in savings accounts and deposits caused by the increase in NBP interest rates. You can currently gain up to 7.05 percent on your accounts annually.

Increases on term deposits are a frequently discussed topic on financial portals. The current maximum rate on the deposit is 7.50% per year, and if you take into account offers with funds – 8 percent annually. To sum up – finding an interest rate of min. 7 percent annually on a deposit is not a difficult task at present.

The same cannot be said for savings accounts, which, compared to deposits, offer much greater freedom of disposal of funds. Currently, only one bank will earn min. 7 percent per year. If customer expectations are slightly lowered – to min. 6 percent annually – the list is extended by another 7 institutions.

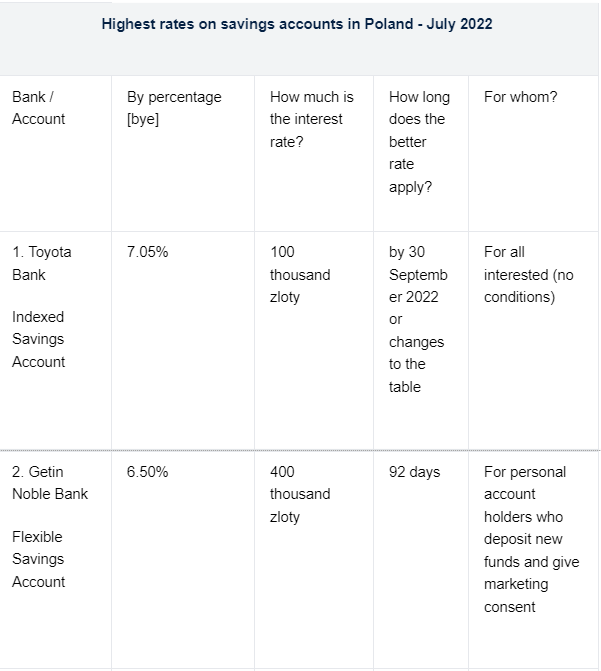

Savings accounts with the highest interest

Currently, only one bank on the market is able to offer at least 7 percent per year in the savings account. For such a rate – more precisely 7.05 percent annually – holders of the Indexed Savings Account at Toyota Bank can count. The offer has no additional conditions, but you should remember about the maintenance fee, which is 30 PLN.

The bank will return it to the customer’s account if he did not withdraw funds from it in a given month. The rate is calculated on the basis of WIBOR 3M and is updated quarterly. The interest rate is 7.05 percent on an annual basis, it applies to savings of up to 100000 zloty. Above this amount, a rate of 4.05% applies per year.

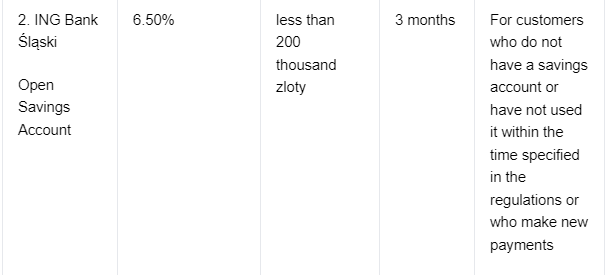

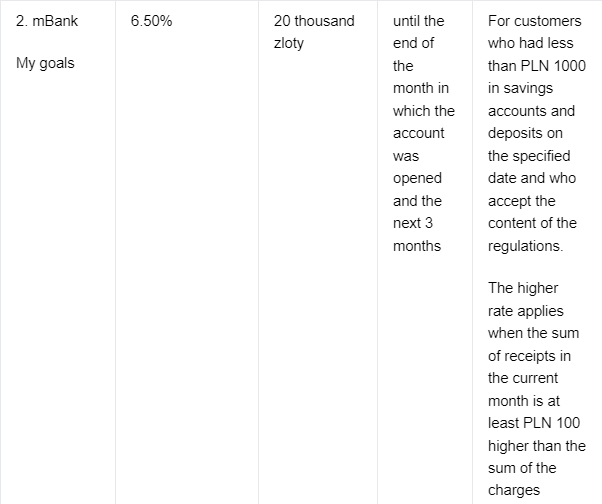

The next “in line” are accounts with an interest rate of 6.50 percent. per year . Those looking for such a rate can count on it in three banks – Getin Noble Bank, ING Bank Śląski and mBank.

The new edition of the promotion “New funds on the Flexible Savings Account” (Getin Noble Bank) provides for a rate of 6.50 percent per year for savings of up to PLN 400,000. Better interest rates apply for 92 days. The offer is addressed to the holders of a personal account who will deposit new funds and give their marketing consent.

The same interest rate accompanies new promotions of the Open Savings Account at ING Bank Śląski 6.50 percent on an annual basis, it concerns funds below 200000 zloty. It will be used by new customers, people who have a savings account but did not use it at the specified time or its holders who deposit new funds. The higher rate is granted for 3 months. Interest resulting from the bonus interest rate is added to the account after the end of the quarter.

6.50 percent per year can also be found at mBank in the My Goals savings account . It is an account that accumulates savings by putting away the so-called end of the transaction. The bank will apply a better interest rate, if the interested party has a personal account, accepts the provisions of the regulations and will provide the account with an amount of at least PLN 100 more than the payouts.

Offer for people who have not used the bank’s deposits or savings accounts within the specified period. The given percentage rate applies to funds up to 20,000 zloty. It is valid until the end of the month in which the account was opened and for the next 3 months.

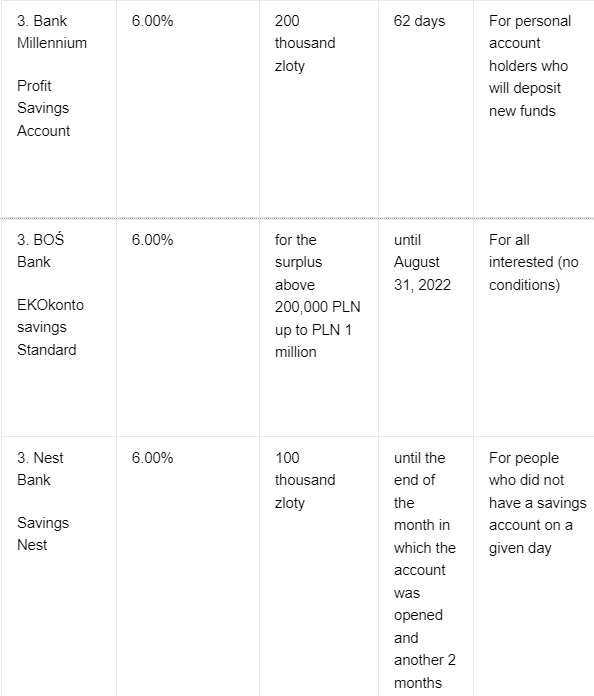

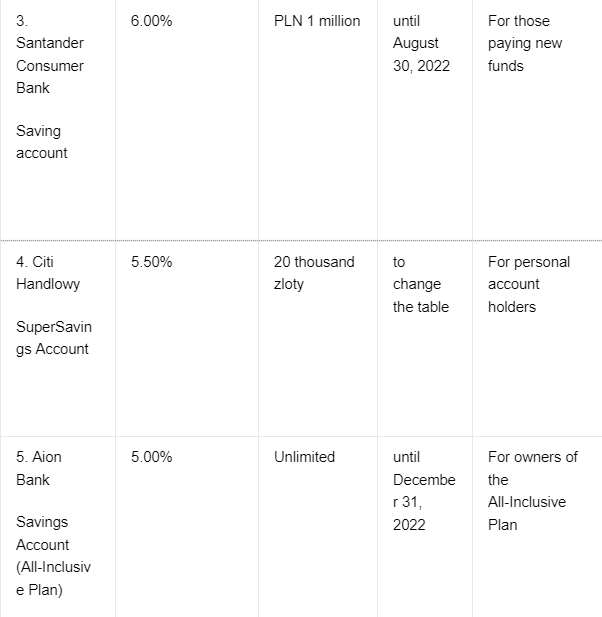

A slightly lower rate, i.e. 6 percent four banks are offered annually – Bank Millennium, BOŚ Bank, Nest Bank and Santander Consumer Bank . Only two of the mentioned institutions expect to have a personal account – Bank Millennium and Nest Bank.

Highest deposit limit was set by Santander Consumer Bank

The highest deposit limit was set by Santander Consumer Bank – PLN 1 million. This is also the border at BOŚ Bank, but there is 6 percent per year, it is calculated only for the surplus above 200 thousand zloty. Both offers have a slightly short duration of the better rate. It will be charged the longest at Nest Bank – until the end of the account opening month and for the next 2 months.

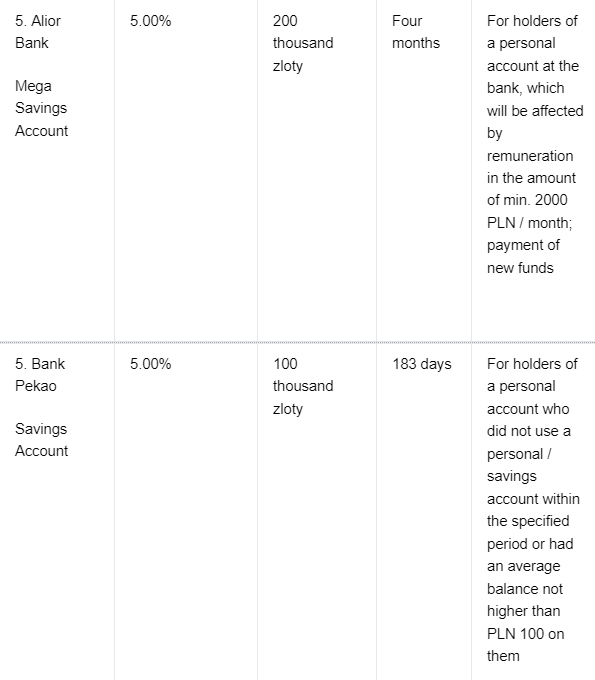

Source: Bankier